RM30000 has to be added back in the companys tax computation which means only RM10000 is deductible as a business expense. These fixed deposits are available in two types.

Solved Please Note That This Is Based On Philippine Tax System Please Put Course Hero

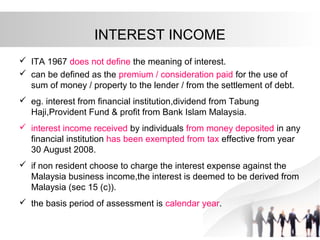

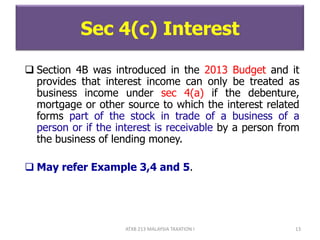

32016 on the tax treatment of interest income received by a person carrying on a business including a company a body of persons a limited liability partnership and a corporation sole.

. According to the new provisions introduced in the 2019-20 budget if the amount of interest earned on fixed deposit exceeds Rs 40000 for a particular person it will attract a tax deduction at a rate of 10 by way of TDS. Accommodation provided by your employer. As part of a Tax Saving Fixed Deposit interest earned is taxable which is deducted at source.

Account-i PNA-i Minimum Deposit. However if you do not provide your PAN details to the bank it will deduct 20 TDS from interest. Employment income includes salary allowances perquisites benefits in kind tax reimbursements and rent-free accommodation provided by the employer.

For example the interest you earn off a fixed deposit or certain dividend payments are fully exempted from income tax. This type of fixed deposit is held by a single person and the investor can claim the tax deduction for his investment in fixed deposit. Interest earned on fixed deposits is taxable as per the Income Tax Act 1961.

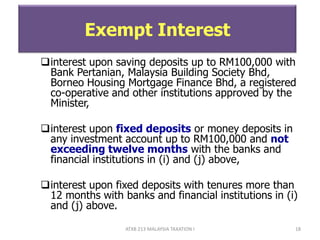

Bonds but not if these are i owned by. The bank will make a TDS deduction on the interest from all the fixed deposits you have with the bank. Interest which accrues in respect of any fixed deposit account including negotiable certificates of deposits for a period exceeding twelve months with Bank Pertanian Malaysia Bank Kerjasama Rakyat Malaysia Bhd Bank Simpanan Nasional Borneo Housing Mortgage Finance Bhd Malaysia Building Society Bhd or a bank or finance company licensed.

RM54400 RM1500 RM52900 Total Taxable Income Tax Exemption Chargeable Income. 1 company trip outside Malaysia for up to RM3000. On 16 May 2016 the Inland Revenue Board of Malaysia published Public Ruling No.

If you deposit 100000 in your savings account for 12 months the bank will in return pay a rental fee interest rate usually between 05-2 to you for borrowing your money. Valuations of some types of employment income are as follows. Among the examples of interest income mentioned in PR 32016 that cannot be treated as business income from YA 2013 are interest charged due to delay in payment of trade debt interest from an easy payment plan interest from fixed deposit placed as security and interest received by a person from loan given to employees.

Maybank Islamic Prosperous Now. This type of income is excluded from counting as your taxable income. 3 company trips within Malaysia.

Income that you dont need to pay taxes for. The holder of a tax-saving fixed deposit can get a tax deduction of a maximum of Rs. The tables below will be updated every month.

Interest received from the following sources is not taxable. If you have FD in one or more bank accounts you should aggregate FD interest from all the banks and declare it as a taxable income under the head Income from Other Sources in the income tax return. As the name suggests this type of.

This was earlier Rs 10000. Deposits with finance companies licensed in Singapore. You can deduct up to 7 of your aggregate income.

Currently it is Rs. So when identifying which fixed deposit account to put your money in the main points of consideration should be interest rates minimum deposit amount and if they are insured by PIDM. Top 1-month FD rates in.

Regular Fixed Deposits provide a loan facility. There are no premature withdrawals loans or overdraft OD facilities for tax-saving FDs. If your interest income from all those FDs goes beyond Rs.

Since a fixed deposit interest is deemed a tax exemption and you dont have any tax relief at the moment we will talk more about tax relief and tax exemption later the calculation would look like this. Any benefits used only for the performance of your job duties. An employee is taxed on employment income earned for work performed in Malaysia regardless of where payment is made.

Deposits with approved banks in Singapore. 40000 then there will be a TDS deduction at a 10 rate. An investor can claim income tax exemption on investments up to Rs 15 lakh when investing in Fixed Deposits.

However the company can claim interest expense against its investment income since the investments are deemed to have been financed by the overdraft. For calculation of FD interest you may ask your bank to issue. Here are the highest interest fixed deposit accounts in Malaysia arranged by duration.

It will be 20 if youve not provided your PAN to the particular bank. The computation of interest expense for each investment source is. Anything not covered by the above list or exceeds the limits of the list will be considered part of your income and will be taxable as normal.

Youll then have earned between RM 500 RM 2000 in 12 months.

Income Tax Testbankanssss Pdf Tax Deduction Taxpayer

Interest Vs Profit Difference Between Bank Company Income Analyst Answers

Corporate Income Tax In Malaysia Acclime Malaysia

How Much Tds Is Deducted On Bank Company And Nro Fixed Deposits Nri Banking And Saving Tips Savings And Investment Investment Tips Investing

9 Types Of Taxable Income In M Sia That You Never Knew

Chapter 5 Non Business Income Students

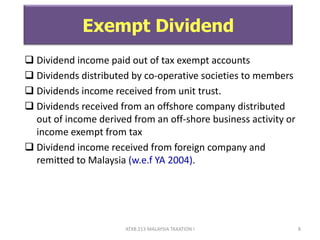

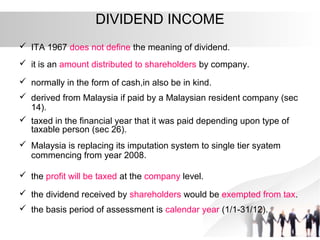

Taxation Principles Dividend Interest Rental Royalty And Other So

Section 80tta Tax Benefits Nri Can Claim 10 000 Inr On Interest Of Saving Account

In The Matter Of Interest Crowe Malaysia Plt

Taxation Principles Dividend Interest Rental Royalty And Other So

Taxation Principles Dividend Interest Rental Royalty And Other So

Taxation Principles Dividend Interest Rental Royalty And Other So

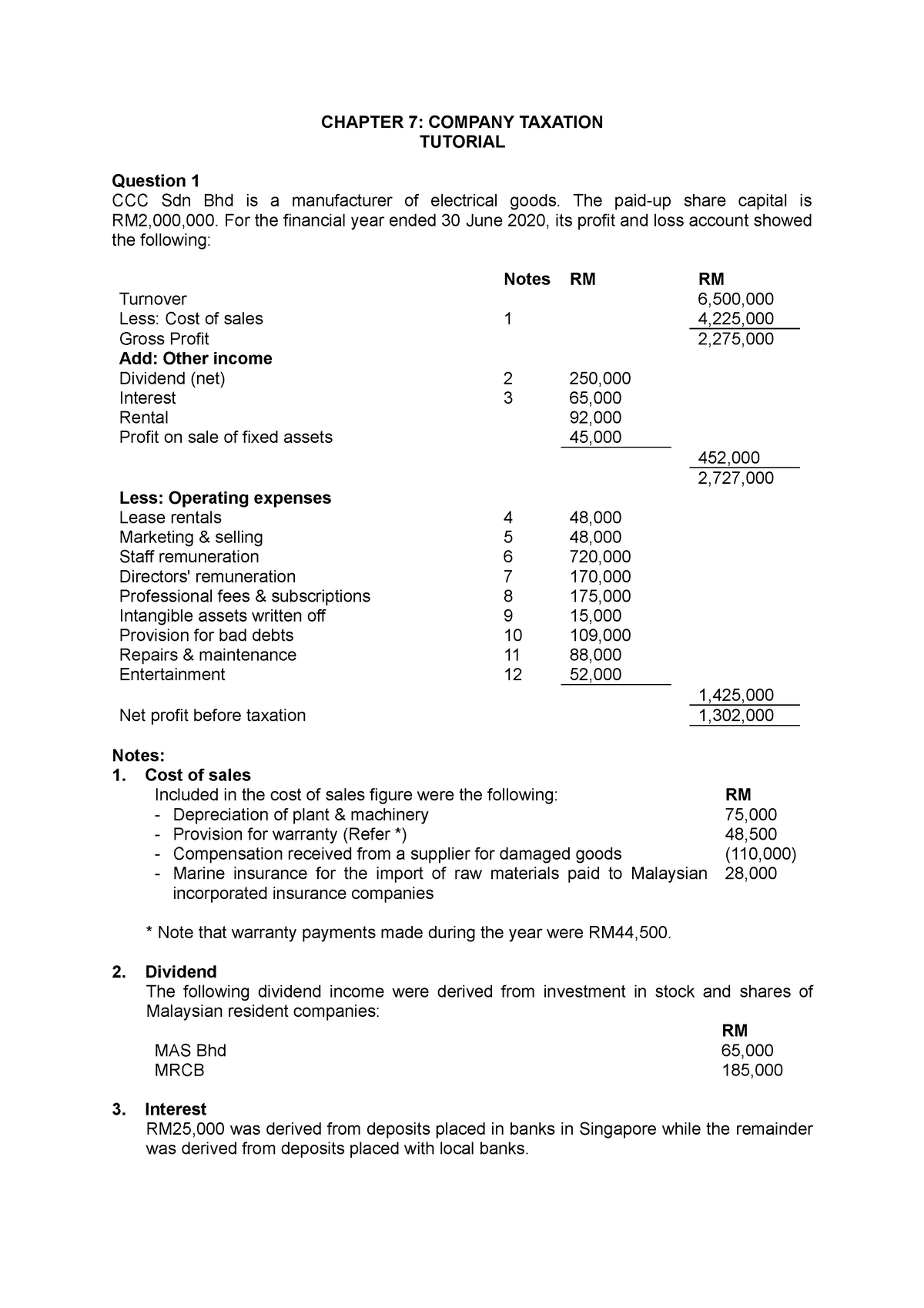

Chap 9 Tutorial Company Taxation Chapter 7 Company Taxation Tutorial Question 1 Ccc Sdn Bhd Is A Studocu

Cukai Pendapatan How To File Income Tax In Malaysia

Ktps Consulting Deemed Interest Income Facebook

7 Rm 68 000 Adjusted Income Capital Allowances For Chegg Com

Chapter 5 Non Business Income Students

Chapter 5 Non Business Income Students

Personal Income Tax Interest Income Tax Treatment